#EmptyNesters Do you want to downsize to a #Bungalow

Take advantage of the current Seller's Market

Go East Young Men and Women to Durham Region

A Great Place to Call Home

Jim Santon and Associates appreciates your busines

We are reaty to "Go the distance for you "

Call us today! Office : 905-434-1011 Direct: 905-409-9967

Tour 1000"s of homes and Condos click here

DURHAM REGION, September 8, 2016 - Durham Region Association of REALTORS® (DRAR)

President Sandra O’Donohue reported 1,132 residential transactions in Au- gust 2016, a 15 per cent increase from the same time last year. “Transaction levels are a true indicator for housing market health,” stated O’Donohue. There were 1,288 new listings in August 2016 compared to 1,328 in August 2015.

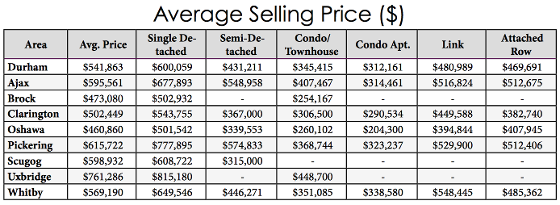

“We’re seeing continued increases in home prices over the summer months,” added O’Donohue. The average selling price in Durham reached $541,863 last month. In comparison, the average selling price was $446,311 during the same period last year; a 22 per cent increase. Homes have continued to sell quickly in an average of 13 days compared to 18 days last year. “Durham Region continues to be an appealing market for home buyers because of its strong economy and quality education, healthcare and social services within arms-reach,” says O’Donohue.

Following the introduction of a tax on foreign buyers in B.C., Vancouver home sales have dropped for the month of August while Toronto home sales topped records. “It’s too soon to tell if Durham Region will be af- fected,” said O’Donohue. “There are a lot of factors to consider when exploring buyer profiles: are the buyers moving into Durham Region for the first time? Were they considering moving here before?”

To build a better buyer profile, Toronto Real Estate Board (TREB) is planning to survey its members this fall on transactions over the last year. “By the end of the year, we’ll at least be able to give a better sense of what share of buying activities is attributable to foreign buyers versus domestic households,” said Jason Mercer, TREB’s Director of

Market Analysis.

While prices in Toronto continue to soar, “waiting for home prices to fall in the Durham Region might not be the best idea,” advises O’Donohue. “If you can afford to purchase a home, it might be time to jump in.”

#DurhamRegion #DurhamRegionRealEstate #PickeringRealEstate #AjaxRealEstate #WhitbyRealEstate #OshawaRealEstate

BREAKING NEWS…

by Bloomberg | 12 Sep 2016

Stricter Mortgage Rules for Banks

Canada’s financial regulator released proposed new mortgage rules that could see the country’s lenders hold more capital to offset risks.The draft guidelines have been updated to “reflect the changing risks in the Canadian mortgage market,” the Office of the Superintendent of Financial Institutions said in a statement. The watchdog said in December it would seek to shift the burden of risks to banks and away from taxpayers, part of a broader effort by government to address what some observers say is an overheated housing market.OSFI floated the policy as part of revised Capital Adequacy Requirements, or CAR, a set of rules governing federally-regulated banks, loan companies, and trusts and based on global requirements. The new CAR framework, published today, is open for comment until Oct.18. It will come into force as soon as November.

If a Canadian lender doesn’t follow the compliance policies set out by OSFI and the mortgage insurers, OSFI may “reduce the level of consideration of the mortgage insurance the lender is using as a guarantee to mitigate its credit risk," according to an agency spokeswoman. In addition, institutions are expected to have appropriate policies and procedures in place to originate, underwrite and administer insured mortgages," the agency said in a document posted to its website. Policy makers have warned that Canada’s housing market is overvalued in some cities and the government is keen to limit taxpayer exposure to any potential downturn. Federal Finance Minister Bill Morneau and the government-owned mortgage insurer, Canada Mortgage & Housing Corp., have floated the idea of banks being required to hold more capital for residential mortgages to protect against defaults.

Morneau said this week additional measures may be needed to manage the risks associated with the “highly charged” Vancouver and Toronto housing markets, even after British Columbia imposed a 15 percent tax on foreign buyers to curb price gains.Under current guidelines, lenders are required to maintain a certain amount of capital to back mortgages, as well as to comply with OSFI risk-mitigation rules. Under the proposed rules, if OSFI determines a lender isn’t following policy, it may reconsider whether its mortgage insurance adequately covers the loan risk, prompting the lender to take further steps, including shoring up capital.

Copyright Bloomberg 2016

#mortgagenews #mortgages #realestatemortgages

Durham Region is a great place for 1st -time buyers to get into the market and build equity. The expansion of the 407 and government investment in Go Train expasion and the shortgage of listings - home prices continue to rise. My advise for 1st time buyers is to find an acitve full time Realtor that is experienced studies the market and pricing daily, has a good knowledge of home construction and good negotiating skills to represent you to resolve problems that come up during home inspections. Buying a home in today's market is hard work, you need to commit the time required to get out and view homes when they come up on the market and don't get discouraged you will be rewarded for your efforts. I understand that buying your 1st home should be fun and wonderful experience, yet with today's market conditions, if your commited and don't give up the fun will come when you quit paying rent and move into your home!

Here is a link to a search I created for 1st Time Buyers Check out the listings.

It will provide you valuable information not available on Realtor.ca, for all MLS listings.

You can create your own search and make it specific to your

In today's market homes are selling for over list price. We study the market everyday and have 20 years experience ensuring our clients get the best results.

For all your Real Estate and Mortgage needs, Call Jim Stanton and Associates Today! We are ready to go to work for you!

#1stTimeBuyers #DurhamRealEstate

Sales still strong with prices on the rise for #MyFallingbrook Neighbourhood for the month of August 2016