Greetings, GTA homebuyers and sellers! As we step into June, it's time to reflect on the dynamic real estate landscape that unfolded throughout May 2024. Join us as we uncover the latest insights and trends from the past month, offering a clear perspective on what May's market stats mean for your real estate journey. At Jim Stanton & Associates, our commitment to providing you with valuable information remains steadfast. Let's explore together the opportunities and possibilities that await in the ever-evolving GTA market.

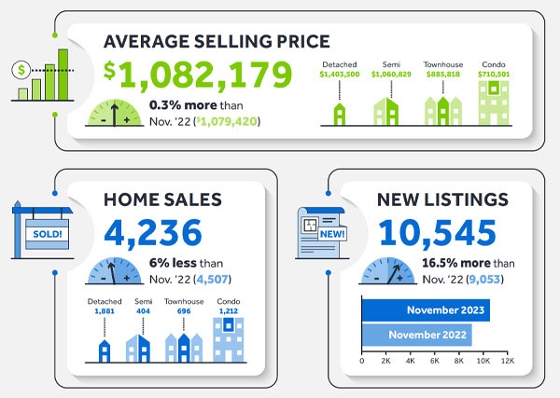

Market Summary: In May 2024, the GTA real estate market showed mixed signals:

Sales Momentum: Compared to the same period last year, sales decreased by 21.7%. There was a month-over-month decrease of 1.42%.

Listing Dynamics: New listings were up 21.1% from 2023 and 9.9% month-over-month.

Active Listings: Active listings saw a significant increase, up 83.3% from 2023 and 20.3% from April 2024.

Price Trends: The average price for homes was down 2.5% year-over-year but saw a slight increase of 0.8% month-over-month.

Balanced Market: With 3 months of inventory available, the market was balanced.

Time to Sell: Days on Market remained stable month-over-month.

Click here to view the TRREB Market Watch Report for May 2024

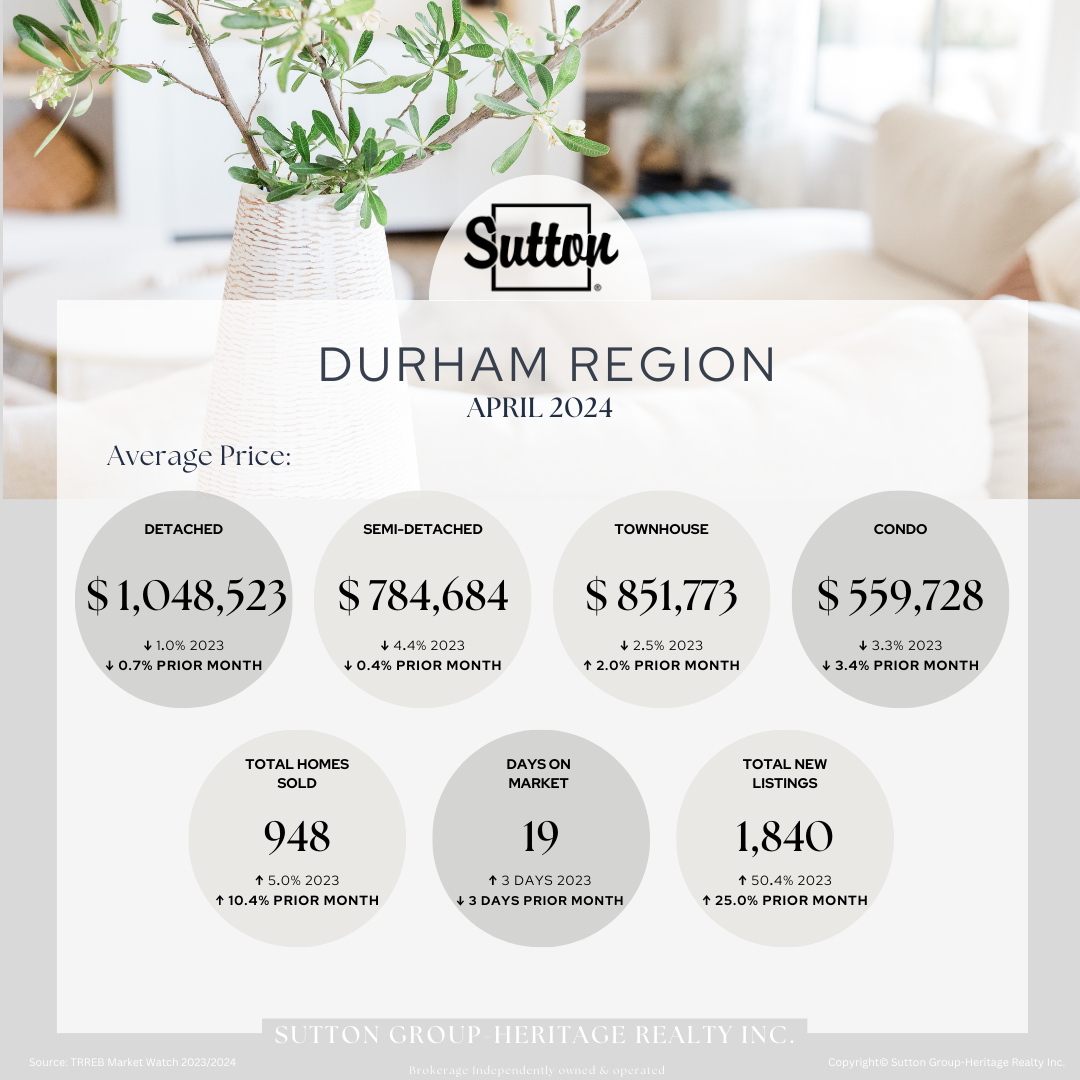

What's happening locally? Durham & Toronto Market Insights

Every city/town is unique as are the communities within them. Scroll through to find your town.

Interest Rates

On June 5th, the Bank of Canada decreased its policy interest rate by 25 basis points. This is the first move since July 2023 and the first reduction since it began increasing the rate in March 2022 from its record low of 0.25%. The last time interest rates were lowered by the Bank of Canada was when the Bank dropped rates to an all-time low at the onset of the pandemic in March 2023.

What Does This Mean for Buyers and Sellers?

For Buyers:

Buyers are poised to benefit from the recent interest rate reduction, which is expected to increase buying power and push more buyers into the market. As a general rule of thumb, a ¼ point decrease in interest rates adds about $10,000 to the average borrower's buying power, though this depends on individual circumstances. However, with more buying power, competition is likely to heat up, especially for entry-level homes. Lower rates can be tempting, but remember that while waiting for further reductions, competition will likely increase. If you buy now, you pay today's prices and can always refinance at a lower rate later. Waiting might get you a lower rate, but you'll likely be paying a higher price.

For Sellers:

Luxury homes have been taking longer to sell in the higher interest rate environment. Hang in there; lower rates may bring more buyers. Expect competition to increase even more on entry-level homes like townhomes and links. These homes are always in demand, and these changes will only spur more competition. With rates finally starting to come down, now is the time to plan your next move. Information is power, and you only benefit by starting the process now.

Conclusion:

In conclusion, May 2024 witnessed a mix of trends in the GTA real estate market, presenting a balanced environment for both buyers and sellers alike. Despite fluctuations in sales compared to last year, there was a notable month-over-month decrease. The surge in new and active listings indicates a healthy influx of properties, while pricing trends remained relatively stable. With inventory levels maintaining a balance, the market is poised for potential changes depending on the upcoming interest rate adjustments. Looking ahead, proactive engagement will be key for both buyers and sellers to capitalize on emerging opportunities. At Jim Stanton & Associates, we're dedicated to providing the guidance and support necessary for navigating this dynamic landscape effectively.

Get the Help You Need:

Regardless of the statistics and the market, you have your own reasons for making a move. A big life event, ambitions, the need to upsize or downsize, or even relocate. The key is to ensure you have someone in your corner representing your best interests. Let us be your guide. Contact Us Today!

-560-wide.png)