Greetings, GTA homebuyers and sellers! As we step into May, it's time to reflect on the dynamic real estate landscape that unfolded throughout April 2024. Join us as we uncover the latest insights and trends from the past month, offering a clear perspective on what April's market stats mean for your real estate journey. At Jim Stanton & Associates, our commitment to providing you with valuable information remains steadfast. Let's explore together the opportunities and possibilities that await in the ever-evolving GTA market.

Market Summary

In April 2024, the GTA real estate market stabalized:

Sales Momentum: Compared to the same period last year, sales came down 5%. There was a month-over-month increase of 8.45%.

Listing Dynamics: New listings skyrocketed year-over-year increase of 47.2% and a month-over-month increase of 29.12%

Price Trends: The average price was stable increasiing 0.3% compared to last year and a with an increase of 3.08% from the previous month.

Slight Seller's Advantage: With 2.54 months of inventory available the market was more balanced. Sellers maintained a slight position of strength.

Time to Sell: Days on Market remained stable month-over-month and with listings taking a couple days more to sell year-over-year.

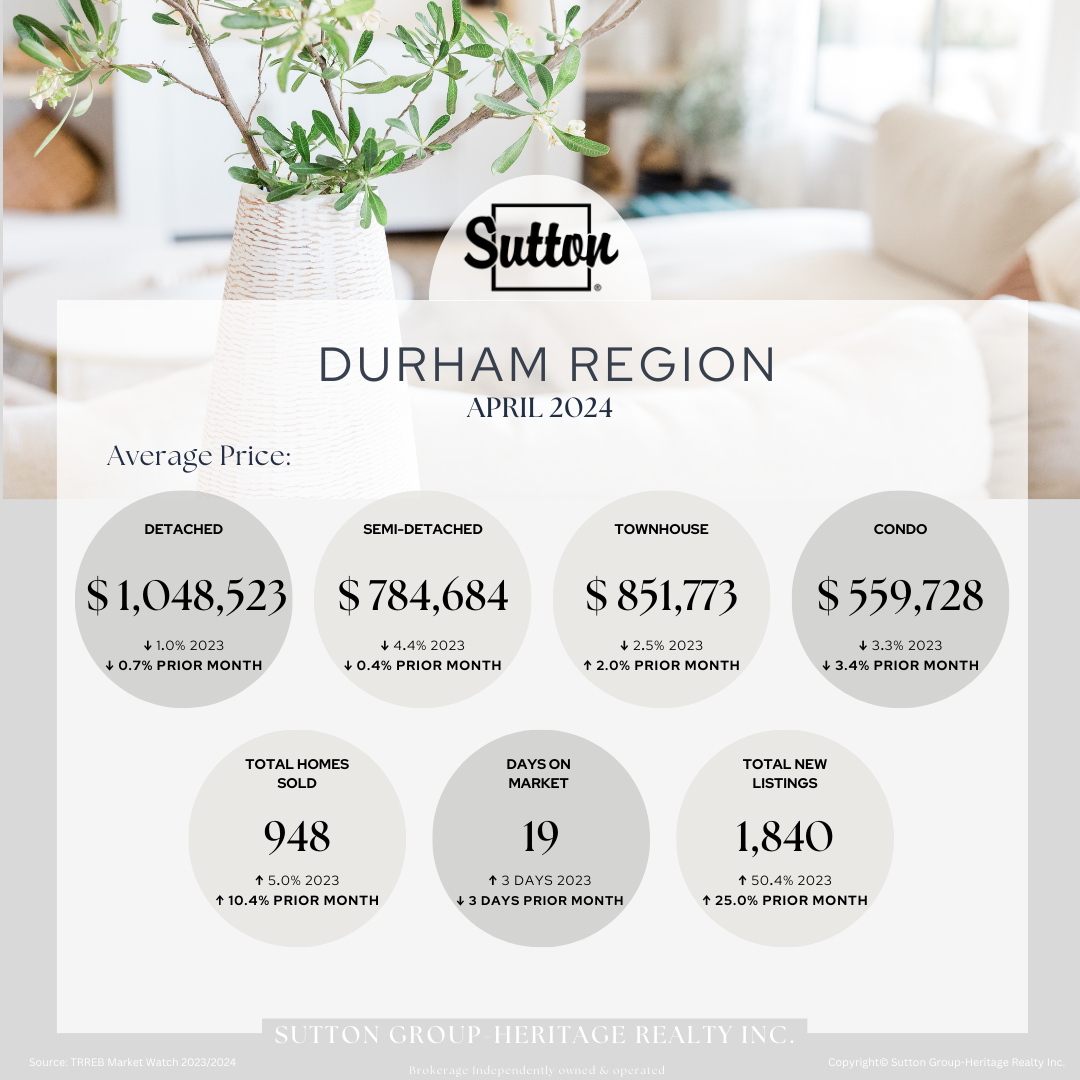

What's happening locally? Durham & Toronto Market Insights

Every city/town is unique as are the communities within them. Scroll through to find your town.

Interest Rates

On April 10th. The Bank of Canada maintained its policy rate. The next scheduled announcement is June 5th. While the Bank has not committed to any specific direction signs are positive that interest rates will be coming down in the future.

What Does This Mean for Buyers and Sellers?

For Buyers:

Buyers benefited from increased in inventory in April and a relatively consistent timeframe to buy although that varies from market to market. The key for buyers will be what happens in June when the Bank of Canada makes it’s next interest rate announcement. The marke is still competitive but it will get even busier if rates come down. Hopefully if that happens more would be sellers will decide to put their home on the market.

Is May your ideal time to buy?: If rates come down in June more buyers will undoubtedly hit the market and only the presence of a massive increase in sellers will keep pricing down.

First Time/Renters vs. Movers: Movers can handle a more competitive market because what they spend in their purchase they can also make up for in their sale. If you are a first time buyer or a renter looking to own you don’t have that advantage.

For Sellers:

Despite a rise in sales and a surge in new listings, low inventory levels persist, intensifying buyer competition and fostering ample opportunities for sellers. While the spring market may be progressing, don't hesitate to act, even amidst the allure of awaiting more favorable mortgage rates. Consider this:

Start Now: If you want to make a move before the school bells ring next year now is the time to act. Get your home prepared to sell. Check out our informative Instagram Reel on this very topic HERE.

Preparation Meets Opportunity: Many sellers are waiting or rates to drop to make a move and that’s understandable. We all know rate relief is on the horizon so start today and be prepared to make your move ahead of the market.

Conclusion:

In conclusion, April 2024 witnessed a stabilization in the GTA real estate market, presenting a balanced environment for both buyers and sellers alike. Despite fluctuations in sales compared to last year, there was notable momentum with an increase from the previous month. The surge in new listings indicates a healthy influx of properties, while pricing trends remained steady. With inventory levels maintaining a modest balance, sellers retained a slight advantage, yet the market remained competitive, particularly in anticipation of potential interest rate adjustments. Looking ahead, proactive engagement will be key for both buyers and sellers to capitalize on emerging opportunities. At Jim Stanton & Associates, we're dedicated to providing the guidance and support necessary for navigating this dynamic landscape effectively.

Get the Help You Need:

Regardless of the statistics and the market you have your own reasons for making a move. A big life event, ambitions, the need to upsize or downsize or even relocate. The key is to ensure you have someone in your corner representing your best interests. Let us be your guide. Contact Us Today!

Call Jim at 905 409 9967

MORE MARKET INSIGHTS (Markham/Stouffville & Port Hope/Cobourg)

.png)