Buyers continue to benefit as sales soften, prices dip, and inventory stays elevated—despite improving monthly momentum.

🔍 By the Numbers: October at a Glance

Total Sales: 6,138 (–9.5% YoY, +9.76% MoM)

Average Selling Price: $1,054,372 (–7.2% YoY, –0.5% MoM)

New Listings: +2.7% YoY, –16.6% MoM

Active Listings: 27,808 (+17.2% YoY, –5.4% MoM)

Sales-to-New Listings Ratio: ~38%

Days on Market:

Property DOM: 50 days

Listing DOM: 31 days

Months of Inventory: 4.53 months — a balanced market favouring buyers

🧠 Top Takeaway

October continued a trend of improved month-over-month sales, but high supply and softening prices create ideal conditions for confident buyers to take advantage of increased affordability.

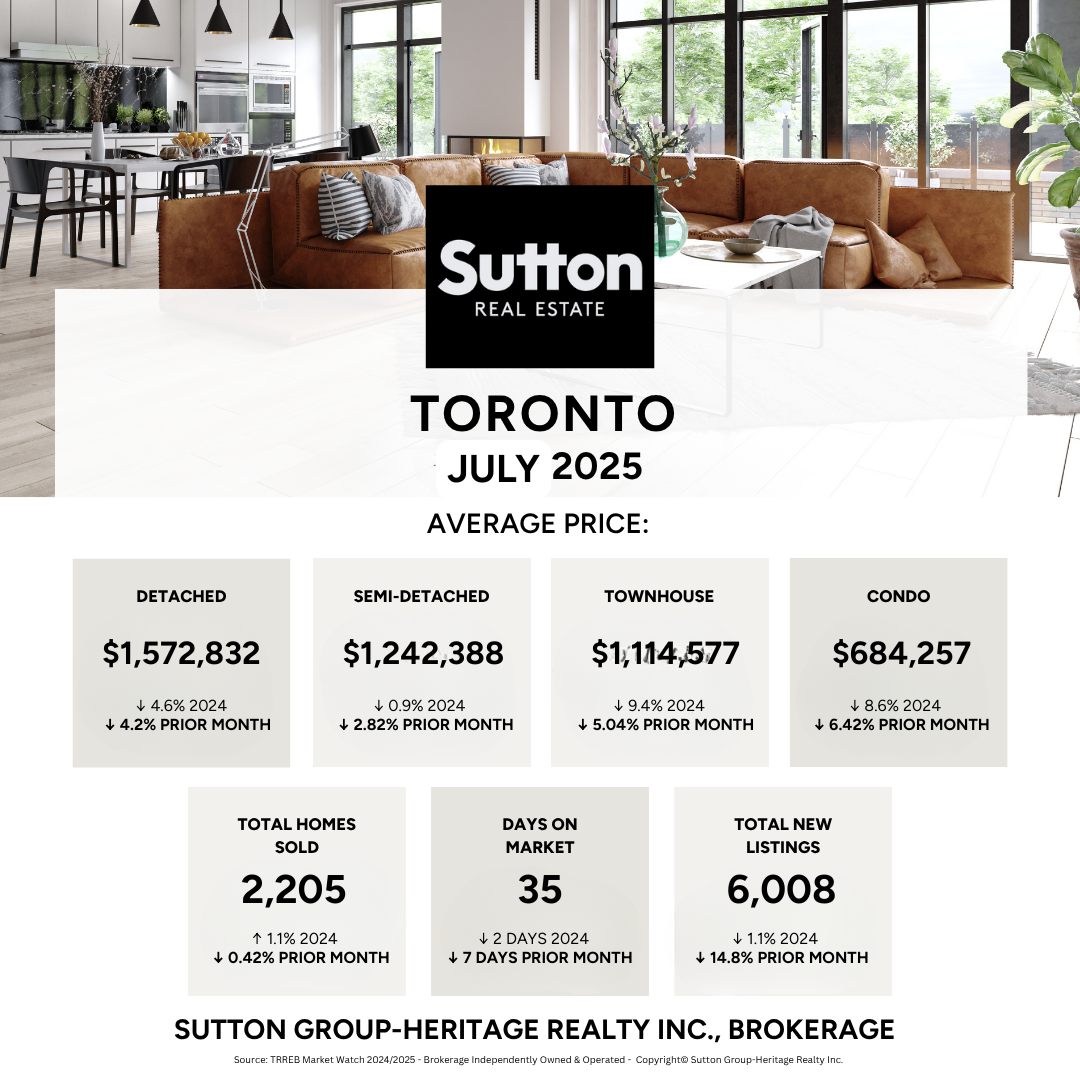

What's happening locally? Toronto Market Insights

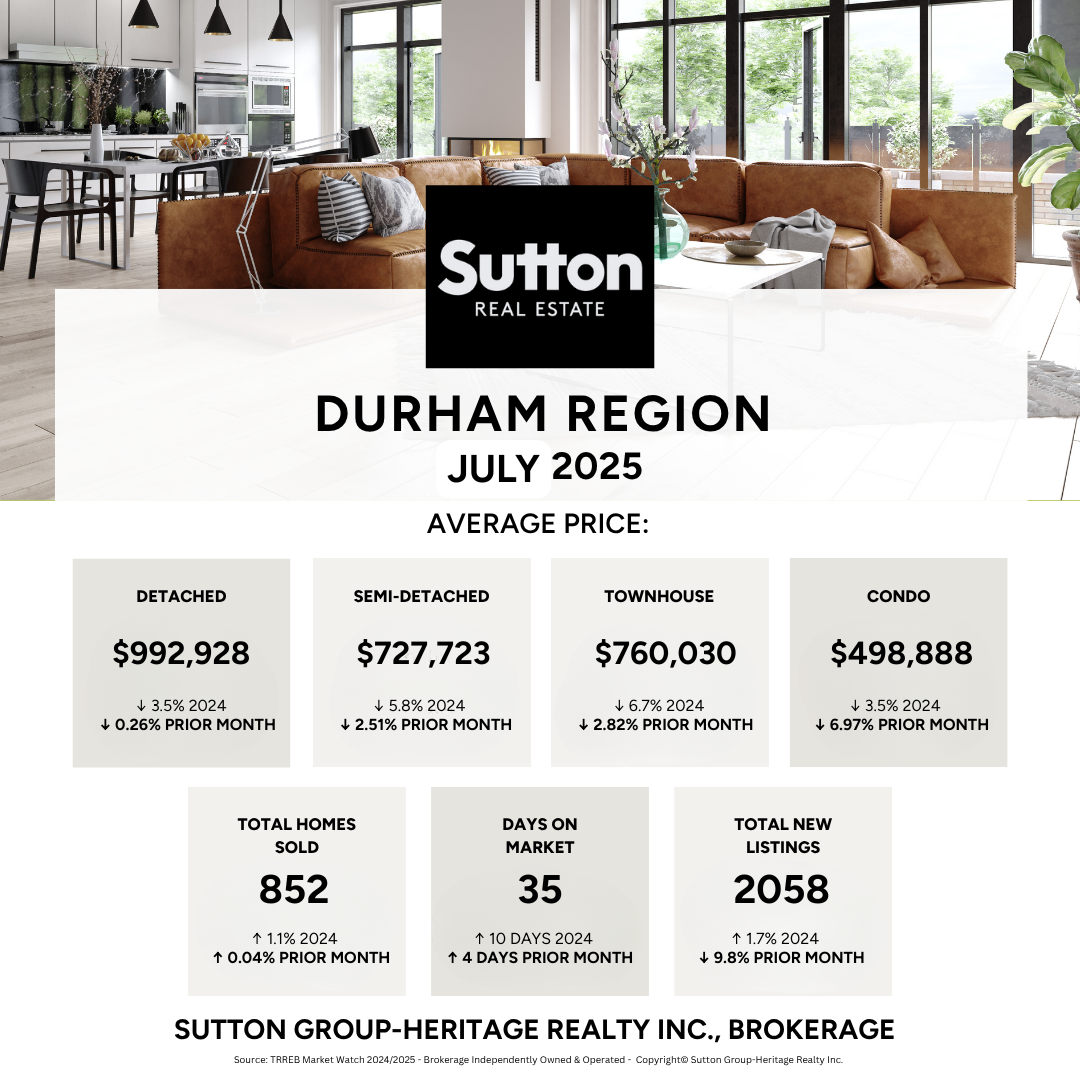

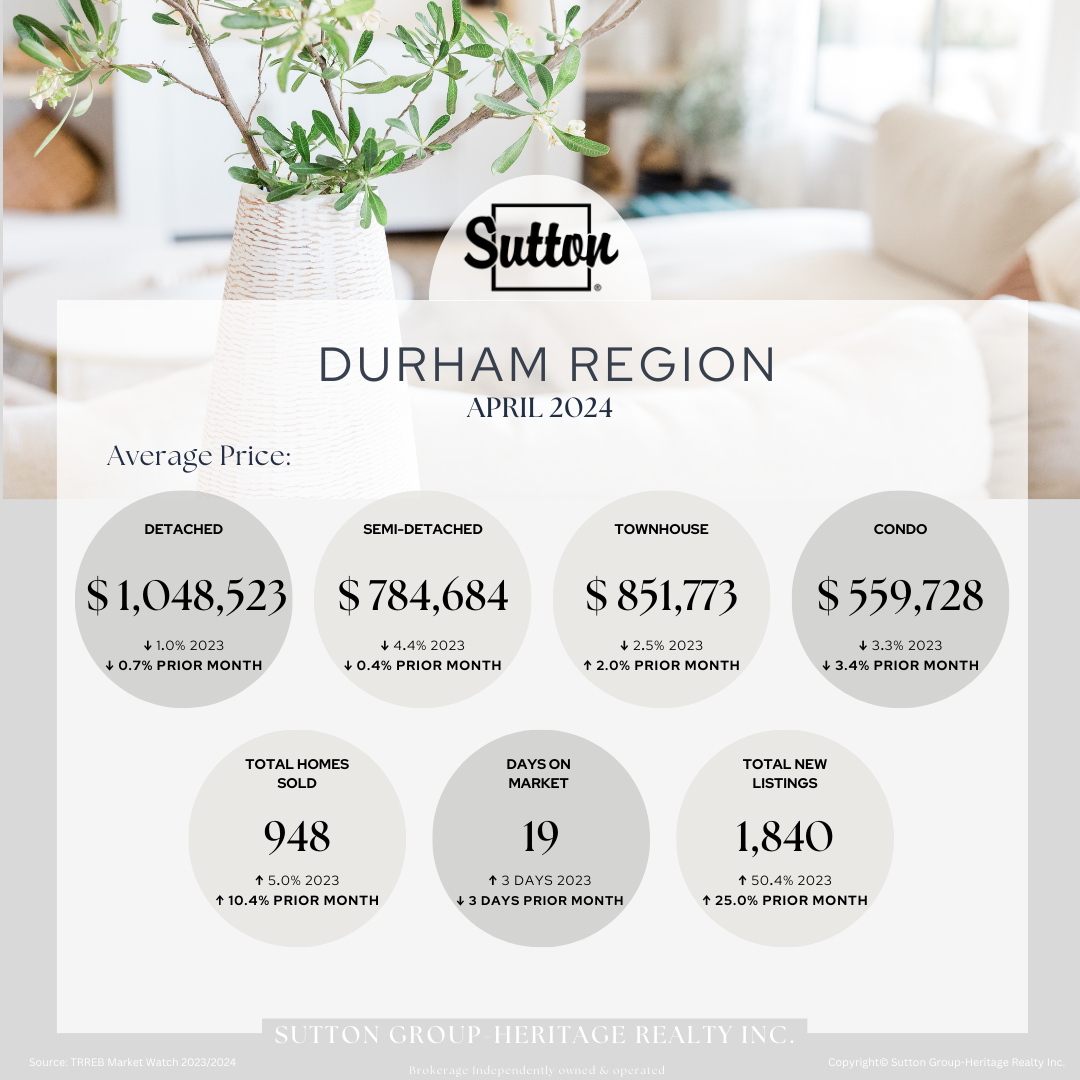

Then what’s happening out east in Durham region. Every city/town is unique as are the communities within them. Scroll through to find your town.

🏘 Segment Performance

Condos

~25.4% of sales

~32% of active inventory

5.7 months of supply → Firm buyer’s market

Condo inventory remains high, keeping conditions highly negotiable for buyers, especially for 1-bedroom and micro units.

Detached Homes

4.5 months of inventory

Moving back toward balance but still leaning buyers

Detached homes show more stability than condos, but elevated supply continues to give buyers leverage.

Durham Region

3.6 months of inventory

Still balanced, but slowly rising inventory is easing pressure on buyers.

City of Toronto

4.53 months of inventory

Improved from earlier in the year but still buyer-leaning

🏦 Economic & Financing Context

The Bank of Canada cut its policy rate by 0.25% in October, marking another step toward improved borrowing conditions.

Variable-rate mortgage holders benefit immediately: for every $100,000 of mortgage debt, the latest prime rate cut translates into savings of about $14 less per month under a 25-year amortization.

Fixed-payment variable mortgages (where monthly payments stay the same even if rates fall) see greater principal repayment when rates drop, boosting equity growth even if the payment doesn’t change.

Home equity lines of credit (HELOCs) and personal lines of credit—both tied to prime—also see immediate interest-cost relief following the prime reduction.

With roughly one-third of outstanding mortgages in Canada still variable-rate, the rate cut offers meaningful financial flexibility for a large portion of homeowners.

Lower borrowing costs could help offset declines in prices, slowly improving affordability—but have not yet been enough to pull hesitant buyers off the sidelines.

Economic uncertainty tied to global trade tensions (U.S.–China, U.S.–Canada) continues to weigh on consumer confidence and spending.

🔄 What’s Changing — and What’s Not

✅ Momentum is returning

Sales increased month-over-month as buyers reacted to lower mortgage rates.

✅ Prices continue to soften

Year-over-year declines persist, October showed the largest YoY price decline of 2025..

✅ Supply remains a powerful market force

High inventory continues to give buyers strong negotiation power despite improving sales numbers.

✅ Rate cuts help—but don’t change the fundamentals yet

Borrowing is cheaper, but broader economic uncertainty continues to hold many buyers back.

⚖️ Buyer vs. Seller Strategy

For Buyers:

You’re still firmly in the driver’s seat.

With lower rates and high inventory, take your time—but avoid trying to time the exact bottom.

There’s meaningful negotiating room in condos and mid-tier detached homes.

If you find a home that meets your needs and budget, the fundamentals favor buying now rather than waiting.

For Sellers:

Price strategically and realistically—do not chase the market downward.

Homes that are priced accurately and show well are selling; homes that aren’t are sitting.

Understand your local competition—especially if selling a condo or entry-level detached home.

Preparation, pricing, and promotion remain critical in this environment.

🔮 Quick Verdict

The Bottom Line:

In October, sales weren’t strong enough to combat softening prices, combined with elevated inventory and a fresh rate cut it created one of the most buyer-friendly markets we’ve seen—giving ready buyers meaningful negotiation power in a cautiously improving landscape.

.png)