If you’re considering a move in the last half of 2025 getting expert insight into the market is a must so this post is for you.

RE/MAX has come out with their annual Fall market update. It not only recaps year-to-date for the Canadian real estate market and highlights communities like Durham Region, but it offers a prediction into what RE/MAX expects to happen by years end.

While our team is with Sutton Group we believe information is power for our clients and the RE/MAX perspective is worth taking a look at. That said, don’t let the headlines dictate your move. Timing the market is full of potential landmines. Before making any decisions speak to an expert and get on-the-ground insights about your market and your situation. Need help? Contact us.

In the meantime lets see what RE/MAX has to say:

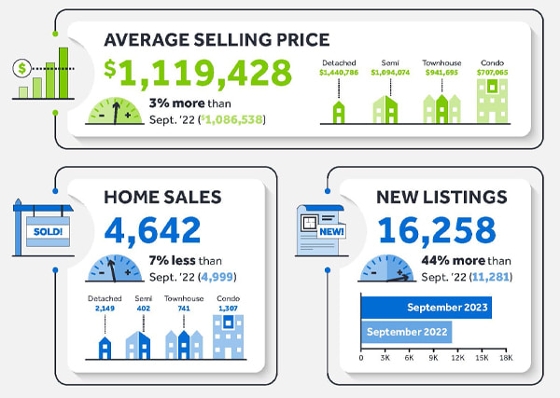

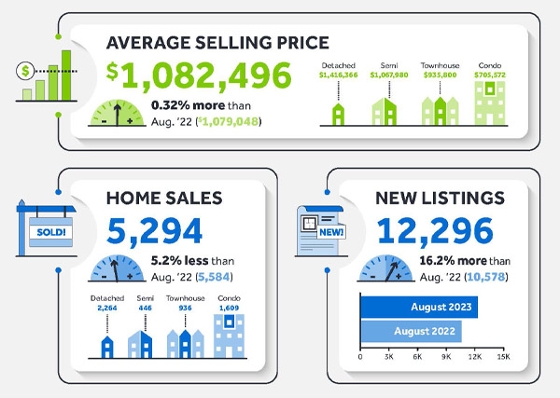

Canadian Real Estate Market Year-to-Date (2025)

Average home price (Jan 1–Jul 3): $900,089, marking a 3.7 % drop year-over-year.

Sales volume (Jan 1–Jul 31): 4,999 units, down 11.1 % year-over-year.

New listings (Jan 1–Jul 31): 13,425, a 14.4 % increase year-over-year.

What’s Ahead for the Rest of 2025

Average price is projected to fall 5 %, landing around $855,085 by year-end.

Sales are expected to decline a further 3 %.

This confirms a buyer’s market nationwide, with inventory climbing and demand softening.

Nationwide, RE/MAX expects the national average home price to slide by 6.5 % and sales to dip by 5 % by year-end. Inventory surges in Ontario and BC are gradually shifting these areas into buyer-favored territory.

Key Takeaways: Canada at a Glance

Buyers hold the leverage. Rising inventory and falling prices give purchasers more negotiating power.

Prices dipping but regionally varied. Ontario and BC see declines, while Atlantic Canada and the Prairies hold firm or even rise.

Shifting buyer profile. First-time buyers now tend to be older (late 20s to 40s), many turning to family help, co-ownership, or strong savings to get in the game..

Sellers adjusting. Expect more realistic pricing, strategic staging, and conditional offers as new market norms.

Falling rates fuel optimism. Inventory up + affordability improving may attract cautious buyers back into the market.

Bottom line: Across Canada, the real estate market is tilting in favour of informed and prepared buyers, while sellers who align with current realities will still find success.

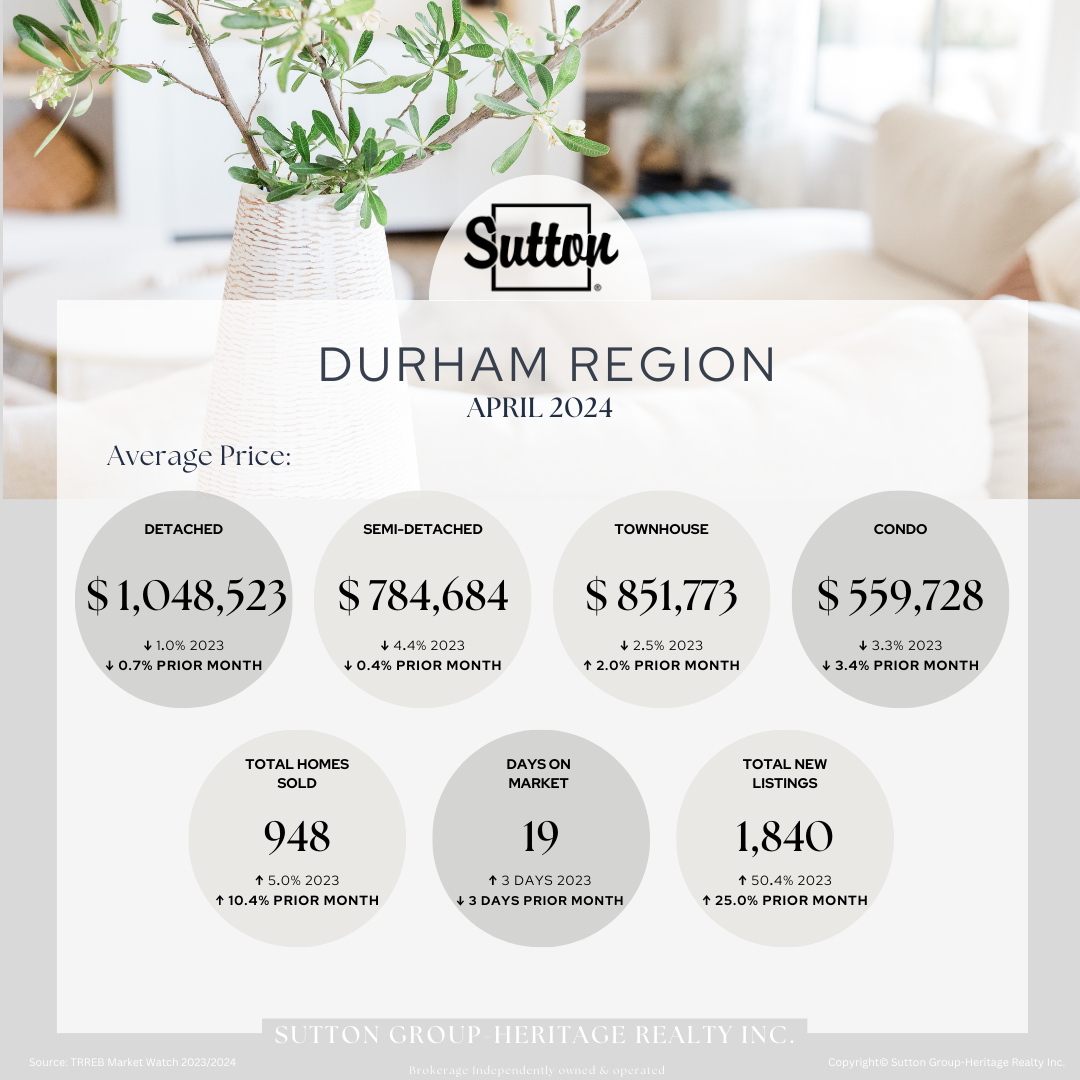

Focus: Durham Region

Here's how Durham Region is shaping up:

Avg. price (Jan 1–Jul 3): $900,089—a 3.7 % drop from last year.

Sales (Jan 1–Jul 31): 4,999 units, down 11.1 %.

Listings: 13,425, up 14.4 %.

Year-end forecast:

Price: –5 %, projecting to $855,085.

Sales: –3 %.

Market type: Firmly a buyer’s market.

Developments in late summer/early fall show continued balance:

Balanced market conditions, with buyers seeing more options and homes staying on market longer.

Inventory nearing 2009 highs, sales down sharply, homes generally selling below list price—especially in southern Durham.

Average September sale price: $842,615 (down 5.8 % year-over-year), with sale-to-list ratio around 98.3 %.

Months of inventory: About 5.6 months, indicating sufficient supply for current demand.

Durham Region Takeaway

Buyers have the upper hand—with more choices and less urgency in bidding wars. Sellers must price smart, time thoughtfully, and stand out in a crowded landscape. Proper preparation and local strategy are key for anyone looking to transact by year’s end.

Final Word:

For buyers, now is a moment of opportunity—leverage the extra inventory and negotiate smartly. Sellers? Align with the market, focus on presentation and pricing, and get the help of a seasoned agent to stand out.

GET THE HELP YOU NEED 👉 CONTACT US

SOURCES: RE/MAX Canada, Narcity, Ceros, renxhomes.ca, REMINET, Yahoo Finance, John Owen

.png)