February Market Watch: Homebuyers continued to benefit from substantial choice in the Greater Toronto Area (GTA) resale market in February 2025.

As we move into the spring market, the February 2025 housing data from TRREB highlights a market in transition. While sales activity showed a modest month-over-month increase, year-over-year figures remain significantly lower. Interest rate shifts, buyer sentiment, and a glut of condo inventory continue to shape market conditions across the Greater Toronto Area.

Market Dynamics

Total Sales: The GTA saw sales dip year-over-year to 4,037 (-27.4% YoY, +4.9% MoM)

Average Selling Price: Selling Prices remained relatively stable averaging $1,084,547 (-4.1% YoY, +1.2% MoM)

New Listings: February saw new listings grow year over-year up 5.4% to 12,066 and down 2.6% from January.

Active Listings: Inventory remains significantly elevated, with year-over-year growth in available properties up 76% and 13.9% above January.

Days on Market:

Listing DOM: Listings sell on average in 28 days (+12.0% YoY, -24.3% MoM)

Property DOM: Listings that terminate and re-list are on for 43 days (+16.2% YoY, -21.8% MoM)

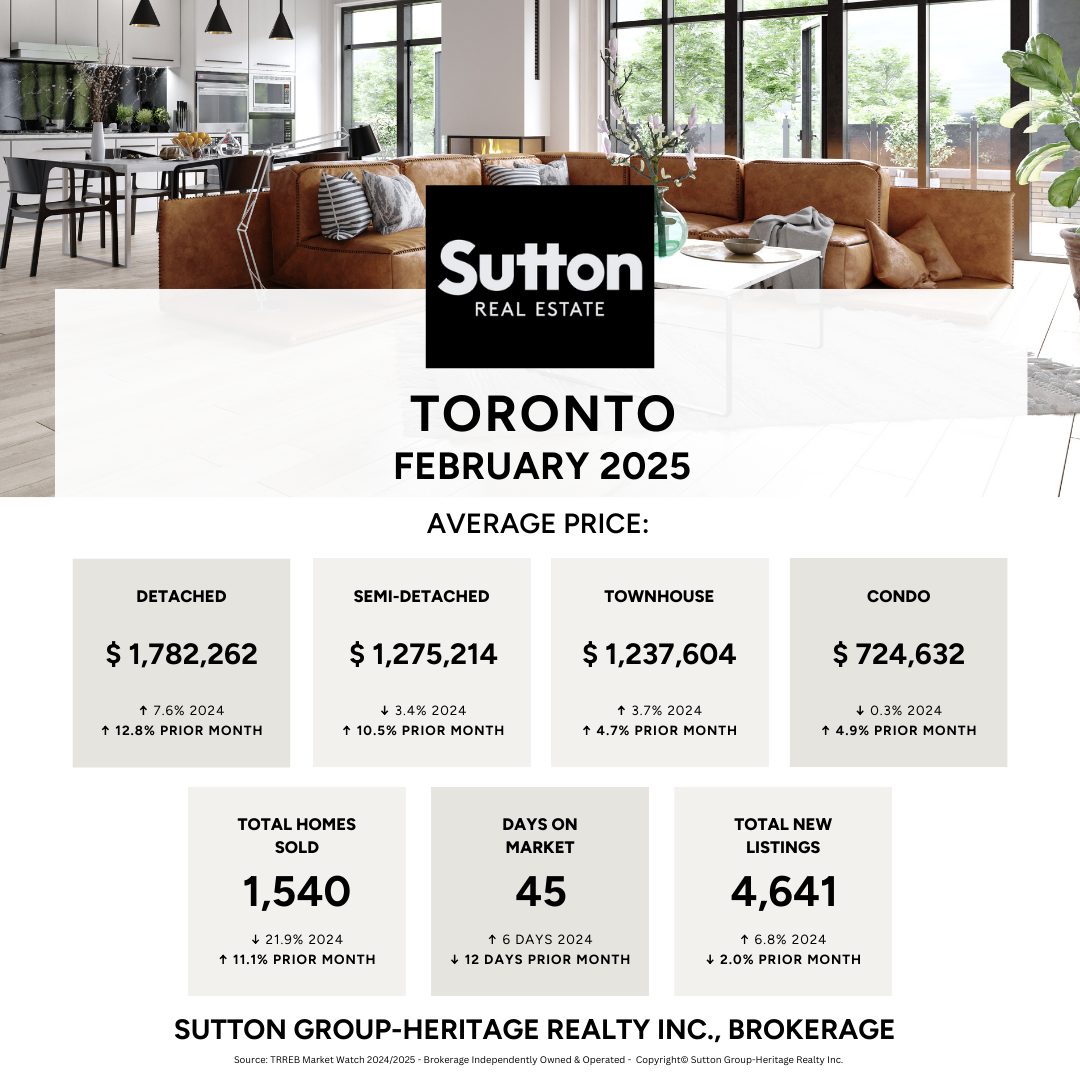

What's happening locally? Toronto Market Insights

Interest Rate & Mortgage Trends

The Bank of Canada (BoC) initiated its first rate cut of the year in January, bringing the policy rate down to 3.00%, and another cut to 2.75% is anticipated in March. This shift is a response to slowing economic activity and declining inflation. Lower borrowing costs are beginning to make homeownership more accessible for some buyers, particularly those considering variable-rate mortgages.

Meanwhile, fixed mortgage rates have also seen downward pressure, reflecting declining 5-year bond yields. As the bond market anticipates further BoC rate cuts, we may see fixed-rate mortgages continue to decrease, offering buyers improved affordability.

Key Market Observations

Sales Remain Subdued, but Price Stability Emerges

While sales volumes are down significantly year-over-year, average prices are showing signs of stabilization. Month-over-month growth in pricing suggests some resilience in the market, particularly for well-priced freehold homes.

More Listings, Longer Selling Timelines

New listings continue to rise, contributing to a more balanced market. While sellers must be strategic with pricing, buyers have greater selection and negotiation power.

The Condo Market Faces Headwinds

In contrast to freehold properties, GTA condos continue to struggle with an oversupply of listings. With more than six months of inventory in some areas, the condo segment remains firmly in a buyer’s market, placing downward pressure on prices and extending selling timelines.

Economic Uncertainty from Trade War Looms

The ongoing trade war between the U.S. and Canada, particularly new tariffs on Canadian exports, has introduced economic uncertainty that could impact job markets and consumer confidence. While the full effect on housing remains unclear, uncertainty makes it difficult to predict long-term trends, keeping both buyers and sellers cautious.

What This Means for Buyers & Sellers

For Buyers:

The market remains favourable for those looking to purchase, with more options and improving affordability as interest rates decline.

Condos, in particular, offer strong negotiation opportunities due to elevated inventory levels.

Well-priced properties in desirable areas are still attracting competition, so preparation and decisive action remain important.

For Sellers:

While prices are showing some stability, strategic pricing and strong presentation are key to attracting serious buyers.

Homes are taking longer to sell, meaning sellers should be prepared for extended timelines compared to previous years.

Freehold properties continue to see steady demand, though pricing realistically in the current market is crucial.

Final Thoughts

The GTA real estate market is evolving as interest rates shift and inventory levels rebalance. While challenges persist, particularly in the condo segment, the broader market is adjusting to more balanced conditions. However, the uncertainty surrounding the ongoing trade war adds an additional layer of complexity, making it difficult to predict the long-term trajectory of housing demand.

As we enter the spring market, staying informed and working with experienced professionals will be key to making the right real estate decisions.

Thinking about buying or selling? Contact us today to navigate the market with confidence!

.png)