The Bank of Canada reviews the finacial banking system twice a year and this attached article provides some insights into the most recent review. Veiw more in this Globe and Mail article here...............

Downsizing Made Easy

As much as we have a love affair with our stuff, a great number of us are facing the reality that “you can’t take it with you.” Literally. It just won’t fit.

Moving presents an opportunity to evaluate what we have and ask the question is it still serving us? Many will seize the moment to purge, at the very least, the broken, obsolete, and redundant.

When we’re facing a move into smaller living quarters, there is the added necessity to eliminate the excess. This is challenging for many people. The good news is that it’s liberating to live with less.

It’s a simple matter of math. We all have the same 24 hours in a day. Those with more stuff have more responsibilities and less free time.

Stuff requires maintenance, which costs us in time, dollars, or both. Our stuff requires space. The cost of keeping stuff is the rent or mortgage divided by the square footage of our space. Multiply the amount of space your stuff takes by your cost per square foot.

And as much as we might love our stuff, most people I know don’t love the time they spend in stuff-maintenance mode. Raise your hand if you want to clean the basement or organize the garage in your free time.

The more you keep, the harder it is to put things away and the longer it takes to clean. Jeff Campbell, author of Clutter Control and Speed Cleaning, calls this VLT. Valuable Leisure Time.

Living in smaller space means you have more time to do things you like with people you love. It is that simple.

Here are my top ten tips to help you downsize with ease.

1. Shift your thinking from how can this be useful? to can I live without it?

2. Do you love it? Does it fit and flatter? Does it spark joy? (thanks, Marie Kundo)

3. Keep fewer containers (including furniture) and you will keep fewer things.

4. Redundancy is overrated. Why keep two when one will do?

5. If an item has an emotional tug, take a picture, then let someone else love it.

6. Minimize the mementos and maximize the white space.

7. Find a charity or three, antique dealer or two, and give yourself a deadline if you are going to sell things yourself.

8. Don’t overfill your new home. Nothing makes something seem small than too much in it.

9. Moving is expensive. The less you take with you, the more you save.

10. It’s never too late to donate. Even as you unpack, remember that “maybe” means you can live without it.

Living in a smaller space requires living with less, but it doesn’t mean we can’t be living large. Our lives are not our stuff. Our lives are our experiences, our people, and our passions. All of which we have more time for when we take stock of our stuff as we move to a smaller space.

It’s a great life!

Sounds like future changes coming to the mortgage industry

As a Reator I support the lastest action with the new down payment requirements coming into effect in the new year. I was concerned the new government would do some knee jerk reaction and institue more drastic changes.

Rob Carrick: Why homeowners should cheer new down payment rules article .....read more

Sounds like future changes coming to the mortgage industry

Below is a Globe and Mail article Friday Dec 11th indicates in part of there article that more changes may be coming as OSFI are planning to update there rules here is a quote from their article.....On Friday, OSFI announced plans to update the rules that dictate how much capital the banks and private mortgage lenders must hold as insurance against bad mortgage loans. Although the proposal is up for discussion, and any changes aren’t likely to be implemented before 2017, there is a decent chance the banks will have to put in place bigger safety cushions to protect against housing-related losses. Here is the full article from the Globe and Mail.

Finance minister announces down payment rule changes

MortgageBrokerNews.ca reported - Finance minister announces down payment rule changes

by Justin da Rosa | 11 Dec 2015

New down payment rules will go into effective February 15, 2016.

“The Government’s role in housing is to set and maintain a framework that is equitable, stable and sustainable. The actions taken today prudently address emerging vulnerabilities in certain housing markets, while not overburdening other regions,” Finance Minister Bill Morneau said in a release. “They also rebalance government support for the housing sector to promote long-term stability and balanced economic growth.”

The minimum down payment for new insured mortgages will increase from 5% to 10% for the portion of the house price above $500,000, the finance ministry wrote.

For example: A $750,000 home will now require $50,000 down -- 5% for the first $500,000 and 10% down for the remaining $250,000.

Properties up to $500,000 will continue to require a minumum of 5% down. Properties in excess of $1 million will still require 20% down.

The changes are meant to reduce taxpayer exposure while supporting long-term stability of the housing market, according to the ministry.

“This measure will increase homeowner equity, which plays a key role in maintaining a stable and secure housing market and economy over the long term,” Morneau said. “It also protects all homeowners, including many middle class Canadians whose greatest investment is in their homes.”

Here is a Globe and Mail article re changes to mortgages

Finance minister to make announcement on housing today?

Mortgage News article this morning

by Steve Randall | 11 Dec 2015

The federal finance minister has scheduled an announcement for Friday morning at 9.30 which is widely anticipated to be about the housing market. Reuters reports that the announcement may set out the government’s plans for cooling the housing market, which could include the rumoured hike in minimum downpayment for CMHC-backed mortgages.

Feds to tighten mortgage rules for homes over $500K

CTV article on proposed increased down payment requirements for home buyers

The new regulations will increase the minimum down payment required to buy a home for more than $500,000, with portions beyond that amount requiring a 10 per cent down payment. The down payment on the first $500,000 will remain at five per cent. see more ..................

1st-time homebuyers at risk of heavy mortgage debt

Below is an article of regarding a recent C.D. Howe study warning that 1st-time homebuyers form a larger segment of home owners have mortgages 5 times their earnings leaving them more vunerable if they haven't saved a reserve fund to help them through either future higher interest rates or job loss.

My experience working with many 1st- time home buyers is they often qualify for alot more that they are willing to spend for their 1st home. They want some disposable income available for other lifestyle choices but in today's hot market they are feeling the pressure to spend more to get into the market. Comments and your thoughts appreciated below

1st-time homebuyers at risk because of heavy mortgage debt, says C.D. Howe study

Young and lower-income households face trouble if mortgages rise or they lose a job

CBC News Posted: Dec 09, 2015 12:52 PM ET Last Updated: Dec 09, 2015 3:28 PM ETv

Mortgage Rates on the inching higher again

Scotia Mortgage Authority raises rates effective today

|

Term |

Revised EVP Rate |

|

1 Year Fixed |

2.94% |

|

2 Year Fixed |

2.44% |

|

3 Year Fixed |

2.64% |

|

4 Year Fixed |

2.79% |

|

5 Year Fixed |

2.99% |

|

7 Year Fixed |

3.64% |

|

10 Year Fixed |

4.14% |

This Weeks Homes For Sale in Durham Region for 1st time buyers

I have sold a property at 23 Alexis WAY in Whitby

Minimum downpayment could rise under Liberal plan

I have been receiving news of possible changes being implemented under a Liberal plan to help cool off the hot housing market. I think these are not extreme measures and something that should have been implemented a few years ago when they reduced the minimum downpayment for a conventional mortgage to 20% LTV. Below are a couple of recent articles to provide you more information .

From Broker News

by Steve Randall | 03 Dec 2015

Minimum downpayment could rise under Liberal plan

The Liberal government could be about to impose tougher restrictions on homebuyers by raising the minimum downpayment for a government-insured mortgage. Mortgage expert Robert McLister says that there could be a sliding scale of downpayment requirements depending on the price of the home. The Huffington Post reports that it could mean a 10 per cent minimum for those buying a home of $700,000 or more; which would particularly hit those in Toronto and Vancouver where average prices are already above that level. Those buying a home above $501,000 would have to find 7 per cent as a minimum. The Finance Department told HuffPost Canada that it does not comment on unconfirmed policy options but that it regularly reviews policies in consideration of the housing market and wider economy.

Financial Post Article by Gary Marr December 2, 2015 2:57 PM ET

Mortgage industry insider says Finance is pondering hike to minimum down payment

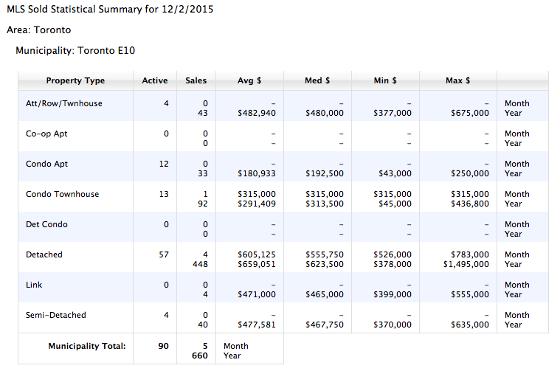

E10 Scarborough November MLS Market Stats

.png)